Ivane Javakhishvili Tbilisi State University

Paata Gugushvili Institute of Economics International Scientific

THE EVOLUTION OF THE ESSENCE OF HUMAN MATERIAL LIFE – FROM ANCIENT ROME TO THE MODERN WORLD

Abstract.In this research, we have studied the ways of success and happiness for the modern human beings. In that filed, Maslow's pyramid, Malthus Theory and Ricardian equivalence are presented, its evolution and impact on life, economy, finance and technology are discussed. Some examples of the lives of successful and rich people (billionaires) are presented, including negative and positive aspects of this path, the current investment trend and the global public debt dilemma is shown

Keywords: Maslow's pyramid, GDP, Happiness Index, Living standards, Easterlin paradox, , Malthusian trap, Ricardian Equivalence, Public Debt.

A modern person, who lives in an environment full of challenges, tries to make his and his family's life as comfortable and effective as possible. In this regard, the peak of success is depicted according to Maslow's pyramid:

Maslow's pyramid - economic/financial essence

(Table 1)

Passing the 1st and 2nd steps is a necessary step of human existence, while the 3rd and 4th steps are the goal of a modern person. The essence of the problem is the transition to 5 steps, which is actually considered the peak of happiness in material and spiritual life.

In fact, the essence of the problem of modern man is to go through 3-4 steps and move to 5 steps. There are a number of problems in this regard, and the most important thing in this regard is what happiness is. The modern economic system offers the following measure of happiness:

- GDP Per Capita

- Social Support

- Healthy life expectancy

- Freedom to make life choices

- Generosity

- Perceptions of corruption

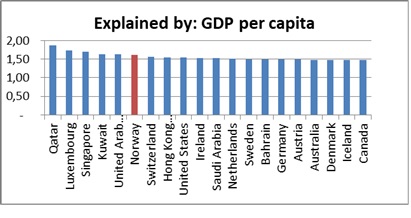

According to an international survey, the view of the residents of developed countries about happiness is depicted in the graph below:

Happiness index 2021 by Countries

(Table 2)

After processing this data, the result of summarizing the data points is the following picture:

(Table 3)

It is noteworthy that the country's GDP and happiness score do not correlate with each other, which proves that GDP level alone is not enough to measure happiness.

(Table 4)

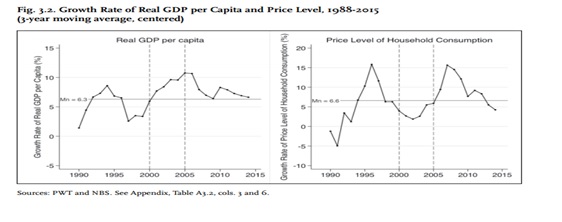

This is evidenced by a study conducted in China, which shows that despite the undeniable and great progress that the Chinese economy has experienced over the past 25 years, the level of life satisfaction in China has not changed.

People in China are no happier than 25 years ago

(Table 5)

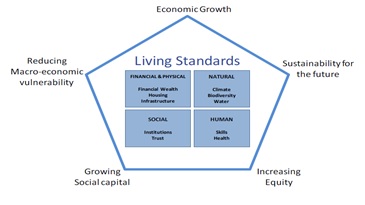

Taking all of this into consideration, the parameters that measure a person's level of satisfaction and success in life should be reevaluated. In this regard, it is useful to use the following matrix:

(Table 6)

Where does growth come from? Increases in output per worker can come from increases in capital per worker. Or they can come from improvements in the state of technology that shift the production. Function and lead to more output per worker given capital per worker.

Unemployment and happiness

The second direction of research is to determine the relationship between unemployment and happiness, that is, how unemployment affects the perception of human happiness.Being unemployed, experiences of unemployment and fear of unemployment reduce people’s happiness. However, some research indicates that when a society reaches a certain economic level, further increases in wealth does not increase happiness to the same extent.

Let’s see what is happening according the Easterlin paradox:

(Table 7)

So, the main question is:

If economic growth does little to improve social welfare, should it be a primary goal of government policy – or should 'gross national happiness' be the main target?

(Table 8)

After establishing the mentioned relationship, it is important to determine how much time the average statistical person has to reach the fifth stage, or the stage of feeling happiness, excluding force majeure events and other exogenous factors. In this regard, the task is simple, because this time is limited by the human life cycle, from which childhood and the formative stage and retirement age should be excluded, in this regard the situation is as follows:

Individual Investor Life Cycle

(Table 9)

As we can see, a person has about 25-30 years to achieve this goal, which is complicated by changes in the economic situation, quite a lot of expenses that go to raising a family and raising children, and other endogenous factors.

According to market conjuncture research, the average annual growth of the capital market and its deviation over the last 100 years are as follows:

(Table 10

As for the annual growth, it has been as follows for the last 34 years:

(Table 11)

That is, as a result of the long-term observation of market instruments, it was revealed that the average returns are 12% per annum, while investing in safe, government-paid securities ranges from 6.6% per annum.

Raising and educating a generation

"Property should be owned by those who use it better" (Ilia Chavchavadze)

It is very important how we raise the new generation and what we aim for. Unfortunately, all links of society, school, higher education are preparing a new generation not for independent business management, but for the role of future clerk and servant. History, culture and literature have a great negative influence here.

In this regard, we offer an excerpt from the famous Georgian literary creator - "Data Tutashkhia".

The essence and purpose of classical education (Dialogue of Mushni Zarandiya)

There is no salary enough for a man. A man must satisfied its need within the salary. The more they give you, the more you want. Salary is not big or small, appetite is big or small.

- My basic salary and another ten rubles is the amount that allows me to use my free time from work, i.e. the remaining four evenings and Sundays, for personal needs. On the other hand, the time I devote to work is worth ten rubles, not five rubles.

In traditional society, people do not see the need to do things carefully and quickly. Time is money - says a modern person, tomorrow - says a traditional person.

Historical economic growth and population growth

From the period of the Roman Empire to the 18th century, there was no significant population growth. The death rate was high. There was no technological progress. In this regard, this period was named the era of the famous English economist - Malthus:

Thomas Robert Malthus, an English economist at the 18th century, argues that this proportional increase in output and population was not coincidence. Any increase in output, he argued, would lead to a decrease in Mortality, leading to an increase in population until output per person was back to its initial level. Europe was in Malthusian Trap, unable to increase its output per person.

This era of Western Europe and today's recognized economic postulates changed during the period of religious transformation:

The old Catholic Church was not focused on economic growth, it preached people to accept their place in life. Protestantism rejected such prohibitions and brought a desire for economic prosperity.

According to the theory of subordination, the gap between the North and the South in the framework of the international economic system is the result of the former's exploitation of the latter.

According to the theory of structuralism, the liberal capitalist world economy contributes to the maintenance of existing differences between developed and developing countries and hinders the economic rise of developing countries.

Subordination is also manifested in the field of capital investments. In the economies of developing countries, a significant or the largest part of capital investments comes from developed countries.

Another form of subordination is financial subordination. A weakly developed country receives financial assistance from the International Monetary Fund, which reserves the right to influence the domestic or foreign economic policy of the recipient country.

The man who changed the Malthusian approach and laid the foundation for today's credit expansion was the world-renowned economist David Ricardo. With the concept of Ricardo's equivalent, the state's approach to debt changed, and in times of deficit in the state budget (wars, force majeure situation), borrowing under the state guarantee was widely allowed. We call this national internal and external debt. However, in the course of time, Ricardo's equivalent demand that the debt should be returned after the crisis has been ignored, and in the modern stage we have an unprecedented growth of financial-pyramidal debt in all leading economies and countries.

Money and property - a different approach and model of success. Does money bring happiness?

To answer this question, we have studied two antagonistic examples:

Henrietta Green was an American businesswoman and brilliant investor. She was recognized as a world classic example of avarice. We also had his counterpart in Georgia in the form of Lavrenti Ardaziani's Solomon Isakich Mejghanuashvili. Her nickname was the witch from Wall Street. This lady earned 15 billion dollars during her 82 years of life. Despite his wealth, the whole family lived in the basement, did not buy the things necessary for life, and saw pleasure only in the accumulation of money and property. She didn't pay for his own son's surgery and the child's leg was amputated, and She died after hearing that the milk seller had overcharged her by a few cents.

A counter example is Sam Walton, the creator of the Wall-Mart shopping network- An extraordinarily ordinary person.

Born March 29, 1918 in Kingfish, Oklahoma. In 1962, he founded Wal-Mart in Rogers, Arkansas. In 1992, he received the highest US civilian award, the Presidential Medal of Freedom.

Walton's 10 Golden Rules:

1. Concentrate on your own business

2. Share the profit with associates

3. Motivation of partners

4. Share information with like-minded people

5. Express gratitude

6. Celebrate success and find humor in failure

7. Listen to those working on the front lines

8. Exceed your customers' expectations

9. Control costs more than the competition

10. Swim against the current wave

In conclusion, we would like to draw attention to how dangerous it is to misuse any economic direction (in this case Ricardian Equivalence), which can be harmful and destructive.

In this regard, we present to you chronologically the statistics of the US federal debt and its current pre-default situation, which we hope will be resolved wisely.

War, crisis, populism and national debt - the example of the USA (in USD)

YEAR Amount

1791 – 75 million;

1914 – 0 dollars

1921 – 15 billion

1940 – 65 billion

1942 - 125 billion;

1943 - 210 billion;

1944 - 260 billion;

1945 - 300 billion

1970 - 400 billion

1980 – 1 trillion

1989 – 3 trillion

2002 – 6 trillion

2007 – 10 trillion

2013 – 17 trillion

2023 – 31.4 trillion

Total US Debt (Federal, States, and State Guarantees) as of May 15, 2023

$31.4 trillion - federal debt

94.3 trillion dollars - total debt (both federal, states, local)

US GDP – 26.2 trillion dollars.

In the Eurozone, government debt to GDP remains close to 100%. Ironically, that’s 40 percentage points higher than the region’s own debt limit. In the UK, the figure has doubled since 2008 to almost 100%. In Japan, the figure is the worst among all high-income economies; close to 265%, thanks to over two decades of secular stagnation.

In the US, the debt ratio has doubled and is inching toward 140%. That’s over 20 percentage points higher than that of Italy amid Rome’s 2010 debt spiral. But unlike Italy (and its bygone lira), America is a global anchor economy and US dollar still dominates international transactions. So, when the US debt crisis ensues, adverse reverberations will be felt from the world economy to global foreign-exchange markets.

Yet, tragically, these are still the “good times.” The year 2023 will be more perilous.

References

- Rich Dad, Poor Dad, Robert T. Kiyosaki, Sharon Lechter;

- Simon Johnson; James Kwak - 13 Bankers The Wall Street Takeover and the Next Financial Meltdown;

- Frank K. Reilly & Keith C. Brown, Investment Analysis and Portfolio Management Seventh Edition;

- Paul Heyne, The Economic Way of Thinking;

- T.Harw Eker, Secrets of the Millionare Mind;

- Ray Dalio, Principles;

- Daron Acemoglu, James A. Robinson, WHY NATIONS FAIL The Origins of Power, Prosperity, and Poverty;

- THE ESSAYS OF WARREN BUFFETT: LESSONS FOR CORPORATE AMERICA;

- Ahamed, Liaquat, The Lords Of Finance

- Adam Smith, AN INQUIRY INTO THE NATURE AND CAUSES OF THE WEALTH OF NATIONS, 1776

- Thomas Malthus, An Essay on the Principle of Population, 1798

- Milton Friedman, Money and Economic Development, The Horowitz Lectures of 1972;

- Origins and the Reasons of Monetary Crises in Georgia (1995-2016)

Author(s):Aslanishvili, David; Omadze, Kristine , Source: Modern Economy, Volume: 7, Issue: 11, Pages: 1232-1250, Published: September 27, 2016, DOI: 10.4236/me.2016.711119 - US STATE SECURITIES MARKET: PAST, PRESENT AND FUTURE AS THE LESSON FOR GEORGIA (Expanded Summary) Author(s): Aslanishvili, David, Source: Materials of reports made at the international scientific-practical conference held at Paata Gugushvili Institute of Economics of Ivane Javakhishvili Tbilisi State University in 2014, Volume: 1, Pages: 488-491, Published: 2014

- Title: Book- Financial Markets & Institutions, Author: Jeff Madura, 13th edition. Published: 2021

- Title: Market Foundation for Sustainable Economy Growth and Energy Policy (Geor-gian Case),Author(s): Aslanishvili, David, Source: Modern Economy, Volume: 7, Issue: 3, Pag-es: 314-319, Published: 20 March 2016, DOI: 10.4236/me.2016.73034

- Title: Ricardo equivalent, the origin of state debt, its meaning and practical purpose Author(s): Aslanishvili, David, Conference: Modern Tendencies of Development of Economy and Economic Science, Pages: 18-22, Year: 2018

- Title: Banking Oligopoly Currency issue and Refinancing loans Banking Oligopoly, Currency issue and Refinancing loans – the main Problems at Monetary policy in Georgia (2013 -2017),Author(s): Aslanishvili, David, Conference: Modern Tendencies of Development of Economy and Economic Science, Pages: 361-367, Year: 2018

- Title: Georgia's external debt structure and the challenges of the current situation Author(s): Aslanishvili, David; Omadze, Kristine, Conference: International Scientific Confer-ence Dedicated to the 65th birth anniversary of Professor George Tsereteli Structural and Innova-tive Problems of Economic Development, Pages: 25-28, Year: 23-24 June, 2017,

- Title: Georgia State Debts as Securitization Example (Expanded summary) Author(s): Aslanishvili, David, Source: Ekonomisti, Issue: 2, Pages: 90-94, Published: 2018

- Title: International Discussions on Bank Credit and Economic Growth Relationship (Expanded Summary), Author(s): Aslanishvili, David; Omadze, Kristine, Source: Ekonomisti, Issue: 2, Pages: 62-74, Published: 2018

- Title: Place and importance of the government securities market in the European Union: recent trends and discussions (Expanded Summary), Author(s): Aslanishvili, David, Source: International Scientific-Analytical Journal EKONOMISTI, Issue: 5, Pages: 12-14, Pub-lished: 2015

- Title: Stock Market in Georgia: Present Reality and Prospective (Expanded Summary), Author(s): Aslanishvili, David, Source: International Scientific-Analytical Journal Ekonomisti, PUBLISHING HOUSE OF PAATA GUGUSHVILI INSTITUTE OF ECONOMICS OF TSU, Volume: 3, Pages: 83-96, Published: 2014